Euronext Amsterdam Dividend Stocks Yielding Up To 7.0%

As the European markets grapple with heightened caution due to escalating Middle East tensions and economic uncertainties, investors are increasingly looking towards stable dividend stocks for reliable income streams. In this environment, Euronext Amsterdam offers a selection of dividend stocks yielding up to 7.0%, providing potential opportunities for those seeking steady returns amidst market volatility.

Top 5 Dividend Stocks In The Netherlands

Name | Dividend Yield | Dividend Rating |

Koninklijke Heijmans (ENXTAM:HEIJM) | 3.38% | ★★★★☆☆ |

Randstad (ENXTAM:RAND) | 5.17% | ★★★★☆☆ |

ABN AMRO Bank (ENXTAM:ABN) | 9.65% | ★★★★☆☆ |

Signify (ENXTAM:LIGHT) | 7.03% | ★★★★☆☆ |

Aalberts (ENXTAM:AALB) | 3.31% | ★★★★☆☆ |

ING Groep (ENXTAM:INGA) | 6.89% | ★★★★☆☆ |

Acomo (ENXTAM:ACOMO) | 6.56% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Koninklijke Heijmans

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke Heijmans N.V. operates in property development, construction, and infrastructure sectors primarily in the Netherlands and internationally, with a market cap of €706.86 million.

Operations: Koninklijke Heijmans N.V.'s revenue segments include €871.03 million from Connecting and €1.83 billion from Segment Adjustment.

Dividend Yield: 3.4%

Koninklijke Heijmans demonstrates a mixed dividend profile. Despite an unstable dividend history over the past decade, recent financials show improvement with earnings growing by 65.5% last year and a low cash payout ratio of 20.7%, indicating dividends are well-covered by cash flows. However, its dividend yield of 3.38% is below the top tier in the Dutch market, and share price volatility remains high. Recent earnings growth further supports potential for future stability in payouts.

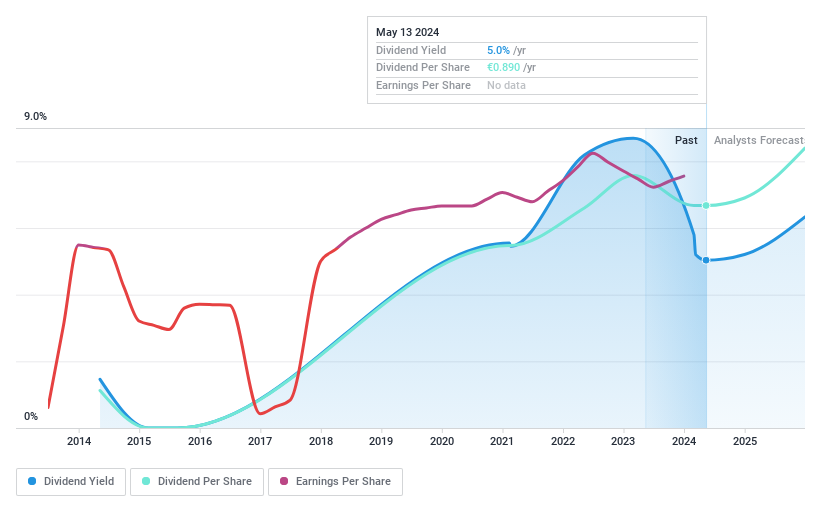

ING Groep

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ING Groep N.V. offers a range of banking products and services across the Netherlands, Belgium, Germany, the rest of Europe, and internationally, with a market cap of €50.75 billion.

Operations: ING Groep's revenue segments include €4.97 billion from Retail Banking Netherlands, €2.61 billion from Retail Banking Belgium, €2.97 billion from Retail Banking Germany, and €6.69 billion from Wholesale Banking, along with contributions of €334 million from the Corporate Line.

Dividend Yield: 6.9%

ING Groep's dividend profile is marked by volatility, with payments over the past nine years being unreliable. Despite this, its current 6.89% yield places it in the top 25% of Dutch dividend payers. The payout ratio stands at a sustainable 69.8%, and future dividends are expected to be covered by earnings at a lower 50% ratio. Recent financials show decreased net income and interest income, reflecting potential challenges in maintaining consistent payouts.

Take a closer look at ING Groep's potential here in our dividend report.

Upon reviewing our latest valuation report, ING Groep's share price might be too pessimistic.

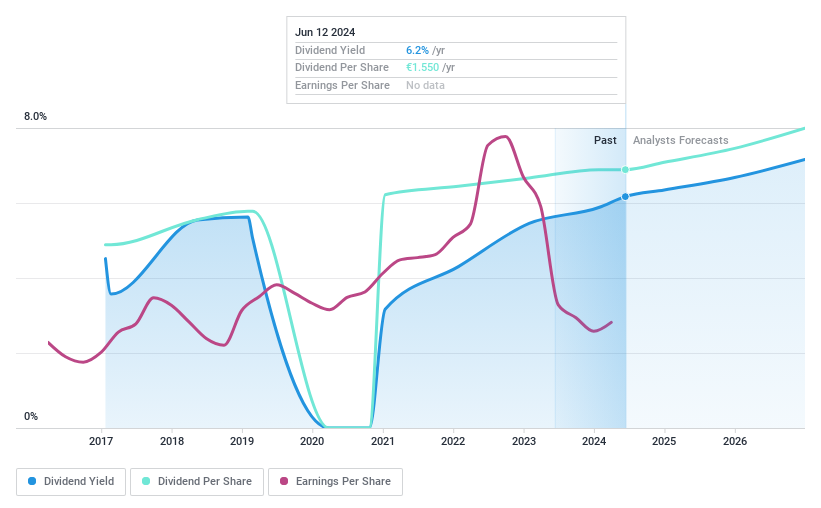

Signify

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Signify N.V. is a company that offers lighting products, systems, and services across Europe, the Americas, and internationally with a market cap of €2.78 billion.

Operations: Signify N.V.'s revenue segments include Conventional lighting, which generated €519 million.

Dividend Yield: 7.0%

Signify's dividend yield of 7.03% ranks it among the top Dutch dividend payers, though its track record is unstable with volatile payments over eight years. Despite this, dividends are covered by earnings (payout ratio: 80.4%) and cash flows (cash payout ratio: 34.2%), suggesting sustainability in the near term. However, recent exclusion from the FTSE All-World Index and declining sales may pose challenges to future stability despite improved net income figures for Q2 2024 compared to last year.

Make It Happen

Take a closer look at our Top Euronext Amsterdam Dividend Stocks list of 7 companies by clicking here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTAM:HEIJM ENXTAM:INGA and ENXTAM:LIGHT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]