Analog Semiconductors Stocks Q2 Highlights: Magnachip (NYSE:MX)

Wrapping up Q2 earnings, we look at the numbers and key takeaways for the analog semiconductors stocks, including Magnachip (NYSE:MX) and its peers.

Demand for analog chips is generally linked to the overall level of economic growth, as analog chips serve as the building blocks of most electronic goods and equipment. Unlike digital chip designers, analog chip makers tend to produce the majority of their own chips, as analog chip production does not require expensive leading edge nodes. Less dependent on major secular growth drivers, analog product cycles are much longer, often 5-7 years.

The 14 analog semiconductors stocks we track reported a slower Q2; on average, revenues beat analyst consensus estimates by 1%. while next quarter's revenue guidance was 1.4% below consensus. Stocks—especially those trading at higher multiples—had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and analog semiconductors stocks have had a rough stretch, with share prices down 5.6% on average since the previous earnings results.

Magnachip (NYSE:MX)

With its technology found in common consumer electronics such as TVs and smartphones, Magnachip Semiconductor (NYSE:MX) is a provider of analog and mixed-signal semiconductors.

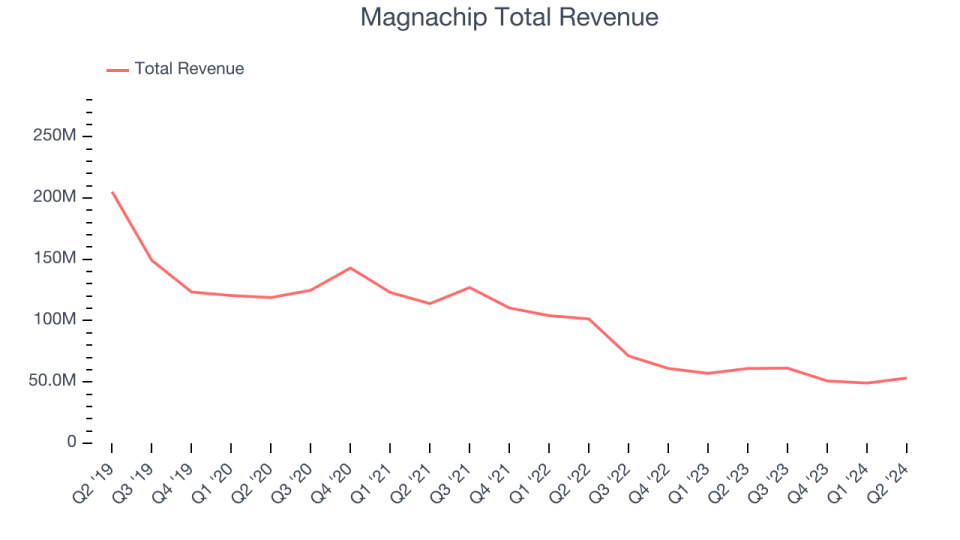

Magnachip reported revenues of $53.17 million, down 12.8% year on year, exceeding analysts' expectations by 3.3%. Overall, it was a decent quarter for the company with a significant improvement in its gross margin but a decline in its operating margin.

YJ Kim, Magnachip’s CEO, commented, “Our Q2 revenue was above the mid-point of guidance and gross margin was better than expected. Revenue in our Standard Products Business, which is comprised of our MSS and PAS businesses, increased sequentially by double digits in Q2. We benefited from a recovery in our Power business, increased demand for OLED drivers for China smartphones and European autos, and an upturn in Power IC demand for OLED IT panels and LED TVs.”

The stock is down 2.5% since reporting and currently trades at $4.97.

Is now the time to buy Magnachip? Access our full analysis of the earnings results here, it's free.

Best Q2: Impinj (NASDAQ:PI)

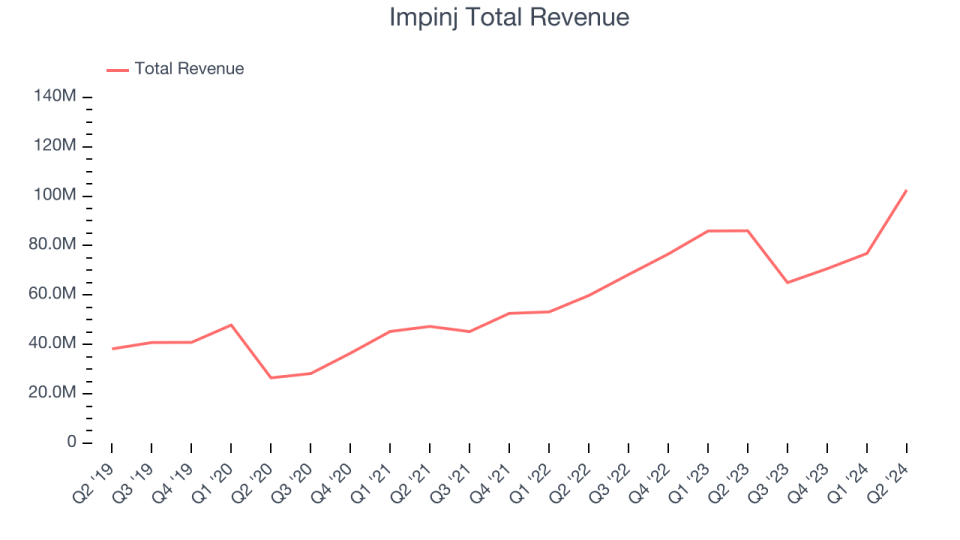

Founded by Caltech professor Carver Mead and one of his students Chris Diorio, Impinj (NASDAQ:PI) is a maker of radio-frequency identification (RFID) hardware and software.

Impinj reported revenues of $102.5 million, up 19.2% year on year, outperforming analysts' expectations by 5.2%. It was an exceptional quarter for the company with a significant improvement in its inventory levels and gross margin.

Impinj achieved the biggest analyst estimates beat among its peers. The stock is flat since reporting and currently trades at $150.98.

Is now the time to buy Impinj? Access our full analysis of the earnings results here, it's free.

Weakest Q2: Universal Display (NASDAQ:OLED)

Serving major consumer electronics manufacturers, Universal Display (NASDAQ:OLED) is a provider of organic light emitting diode (OLED) technologies used in display and lighting applications.

Universal Display reported revenues of $158.5 million, up 8.1% year on year, in line with analysts' expectations. It was a weak quarter for the company with a miss of analysts' EPS estimates and full-year revenue guidance missing analysts' expectations.

As expected, the stock is down 21.4% since the results and currently trades at $167.

Read our full analysis of Universal Display's results here.

ON Semiconductor (NASDAQ:ON)

Spun out of Motorola in 1999 and built through a series of acquisitions, ON Semiconductor (NASDAQ:ON) is a global provider of analog chips specializing in autos, industrial applications, and power management in cloud data centers.

ON Semiconductor reported revenues of $1.74 billion, down 17.2% year on year, in line with analysts' expectations. Zooming out, it was a weak quarter for the company with underwhelming revenue guidance for the next quarter and an increase in its inventory levels.

The stock is up 2.5% since reporting and currently trades at $71.91.

Read our full, actionable report on ON Semiconductor here, it's free.

MACOM (NASDAQ:MTSI)

Founded in the 1950s as Microwave Associates, a communications supplier to the US Army Signal Corp, today MACOM Technology Solutions (NASDAQ: MTSI) is a provider of analog chips used in optical, wireless, and satellite networks.

MACOM reported revenues of $190.5 million, up 28.3% year on year, in line with analysts' expectations. Revenue aside, it was a slower quarter for the company with a decline in its gross margin and an increase in its inventory levels.

MACOM pulled off the fastest revenue growth among its peers. The stock is flat since reporting and currently trades at $101.41.

Read our full, actionable report on MACOM here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.